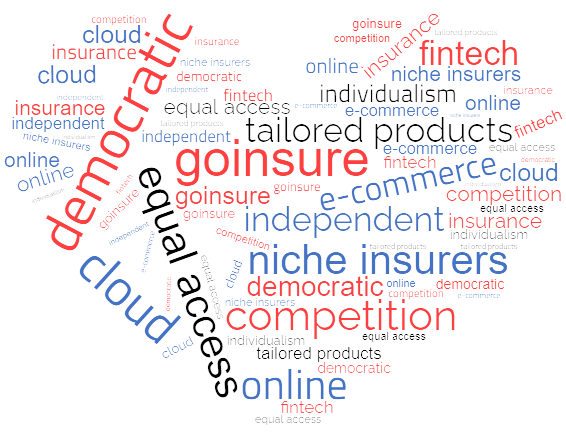

Democratization of insurance via on-line platforms

The market is not quite perfect yet

The general insurance market has in many years been characterized by the fact that there are a few big insurers who, due to large equity capital, have favourable terms to make an impact on the market through intense marketing, advertising, and direct influence.

This way of reaching customers and insurance brokers is expensive and time-consuming, but it caters to the big players in a way that can be said to hold down market shares and make the opportunities for new suppliers less attractive. It must be associated with thorough deliberations between management and investors before any decisions on investing in availability on the market, as it has so far been associated with large costs to “break the ice” for a new product and/or a new supplier.

This effect probably makes the insurance market more stable, but on the other hand less attractive for insurance buyers, as there is thus a limited supply and less competition on the market.

The brokers make a great effort to promote competition, but if you as a broker cannot convey a significant portfolio, then there are not that many suppliers who will venture into new adventures.

A few companies have tried their hand at niches and single products, but unfortunately with less success, which has led to everything from withdrawal of the products to outright bankruptcy.

It has typically been the agencies that have been most successful in introducing something new to the market, but their volume is however modest compared to the overall market.

Previous attempts to digitize the market

Several insurance platforms have emerged in recent years. The platforms have primarily aimed at the private market, and some have worked according to “get three offers” or “compare offers” on a limited number of products – typically car insurance or standard private insurance.

There has been the most success with digital platforms, where a company or an aggregator offers a limited number of products and thus does not present a range of options, but something “just for you”.

A solution like the US-based Lemonade, which successfully markets itself online with 5 standard products, is quite typical and is being imitated in many countries.

Hedvig is an example of this, they have withdrawn from the Danish market in 2023 and are now only in Sweden.

Other attempts at digitization have primarily been based on the insurance companies’ existing websites, to which an option has been added to hand in data and receive an offer afterwards – or in fewer cases, be able to receive an offer immediately but then be contacted by an insurer.

Companies typically do not want to provide too much data before they can see if they are interested at all, and the brokers need it to be easy and usually do not need to discuss the matter much with a UW person from the insurance company.

There are thus not many platforms where it is possible for different suppliers to post products and manage the communication with the potential customer themselves. risk issues and conditions etc.

With goinsure, there is room for small, large and specialists on the market

Due to the low-cost level of a modern, digital, and open-source driven portal, it is now possible to “democratize” the presentation of insurance. Everyone can join and you are not dependent on a large marketing budget or follow-up sales to get in touch with interested customers and their brokers.

Thereby, the interest is not created by the insurance companies having to use resources and time on “push” marketing, but by the platform reaching out to the potential users with inbound marketing.

The costs for the companies can be minimized and used in other contexts.

This will result in a more perfect market, as it will largely be the quality of the product in the form of conditions, options for choosing coverage etc. that will determine how competitive the product is and which product the customers choose.

Brand awareness and the marketing of the individual insurance companies with advertising and direct sales will become less important – and in this way a certain “democratization” of the insurance market will be created.

GoInsure will try to live up to the objective that there must be room for everyone so that the insurance companies can put interesting products on the marketplace and the many different players can test the products and choose the ones that best suit the company in question.