Is the B2B Insurance market ready for e-commerce?

The number of B2C eCommerce users in Europe is on a sharp rise, with countries like UK, Ireland, Denmark, and Greece as frontrunners. And according to ECDB the European eCommerce Market is estimated to be worth US$750 Billion in less than 4 years.

But here in 2023, where you can buy practically any kind of product and service online, why is it that business insurance constitutes such a minimal share of online sales ?

Before trying to answer this question, let’s look at the opportunities and pitfalls for buying business insurance online.

The two current concepts for online insurance

Behind any current online sites for insurance is one of following two concepts:

- Price comparison site, comparing different carriers on one specific insurance product at a time.

- Single insurer site, offering a wider bouquet of insurance products from one specific carrier.

The strengths of a comparison site are that it can give you a strong indicator of where to find the best quote for a specific insurance product, and sometimes also a good overview of optional coverages and added costs on variable limits and deductibles.

The disadvantage is that it is only suited for non-complex insurance (standard) products with very little variance in coverage and price factors. To enable the comparison site to scan multiple insurers tariff engines, you often need to provide a lot of input that might end up not being relevant for your exact needs. And be aware that not all comparison sites are as independent as they seem or claim to be.

The weakness of staying true to one insurer/carrier would often be that smaller specialized carriers are excluded as they can only cover a part of the business. It is in insurance like in most other trades; no one can be experts in everything !

goinsure, the 3rd way for online insurance

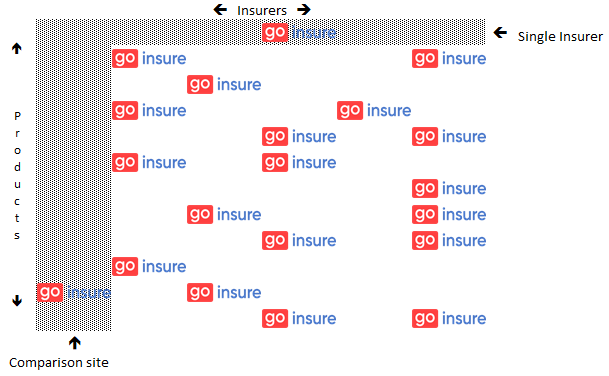

While a price comparison site looks wide across multiple carriers, but narrowly on specific products, the single insurer site is deep on products but obviously as narrow as can be on carriers.

But instead of going narrow on either products or carriers, a concept like goinsure now offers the full matrix, proposing independent insurance shopping across multiple products and multiple carriers in the same marketplace.

As an independent marketplace for insurances, goinsure can provide online quoting and binding of insurances across the matrix. You are not bound to one row (Insurer) or one column (Product) but can generate quotes on any combination you like.

No insurer has higher preference than others, and small specialized carriers can bring to market exactly those products where they are highly competitive. The concept is based on the insurer paying a little fixed traffic fee for insurances sold on the goinsure marketplace, and no agents are in the middle earning commission.

The users around this ecommerce marketplace for insurance can be individual businesses or private users as well as brokers mandated by business clients. Everything around the quoting process is handled online on the portal exempting the user from unwanted communication from insurers and agents.

Leave the comparison to the broker!

If you are reading this as a business owner, you might think this new concept would eliminate your need for using an insurance broker. Before you draw this conclusion, be aware that even the smallest company is unique and can have special insurance needs.

Brokers are experts in insurance and risk and can provide you with advice on the insurance your business really needs to survive and thrive – not just what you think it might need. They know the insurance markets, and they know the risks facing businesses of all types, so you can be confident that the insurance you end up with will protect your business in the event of an incident or claim.

Good insurance brokers deliver a personalized service and take time to understand your business. Knowing the insurance market as well as your business, they would also have a safe hand in an ecommerce marketplace like goinsure.